Introduction: Unlock Rewards with CAW Staking

CAW (A Hunters Dream), a pioneering crypto project for decentralized social networking, offers users a powerful way to participate in its ecosystem: staking. By staking CAW tokens, you can earn rewards while supporting the network’s growth, making it a win-win for both you and the CAWMmunity. Whether you’re a seasoned crypto investor or new to Web3, this CAW staking rewards guide will walk you through the process, benefits, and strategies to maximize your earnings.

In this article, we’ll explore how CAW token staking works, the role of Layer-2 (L2) and validators, and how token burning enhances your rewards. For a broader overview of CAW, check out CAW – A Hunter’s Dream, a Pioneering Crypto Project for Decentralized Social Networking. Let’s dive into the world of CAW staking!

How CAW Staking Works

Staking with CAW’s mainnet launch

The O(1) Algorithm: Efficient Reward Distribution

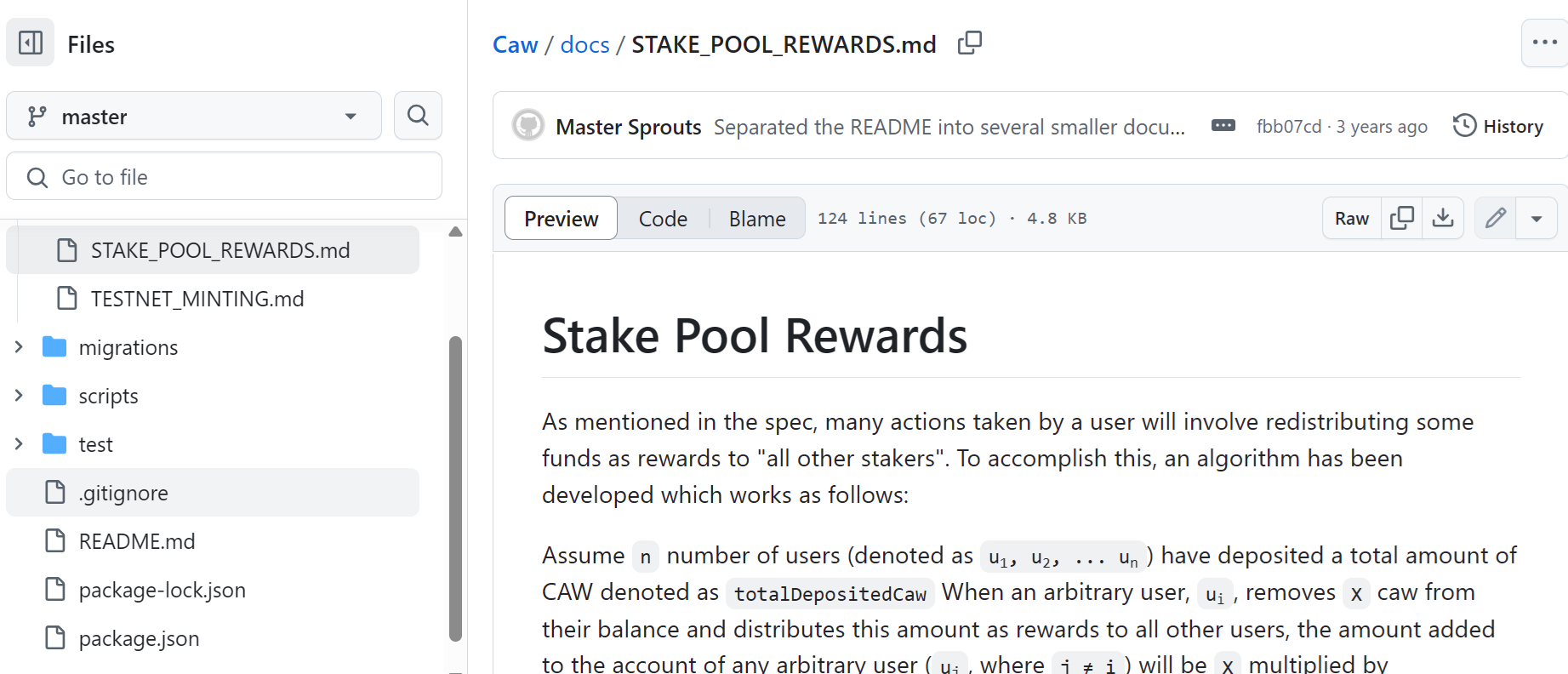

CAW’s staking mechanism is powered by an O(1) algorithm, as detailed in the STAKE_POOL_REWARDS.md file. This constant-time algorithm ensures that rewards are distributed quickly and fairly, regardless of the number of stakers. Whether there are 1,000 or 1,000,000 participants, the system processes payouts in a single operation, making CAW’s staking scalable and gas-efficient – a key feature for a project aiming for mass adoption.

Sources of Rewards and Token Burning

How Rewards Are Funded

Since CAW has a fixed maximum supply of 666 trillion tokens, rewards aren’t generated by minting new tokens. Instead, they’re funded through fees collected from ecosystem activities, such as:

- Cross-Chain Transactions: Actions like deposits and withdrawals across blockchains.

- NFT Minting: Fees from minting NFT usernames, a feature coming with CAW’s mainnet launch.

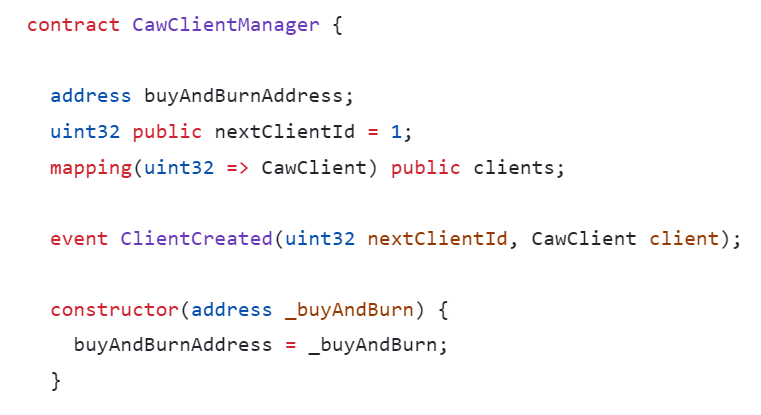

These fees are collected by frontends (known as CawClients) and split into two parts: a portion is used to buy and burn CAW tokens, while the rest is added to the reward pool for stakers. The more activity in the CAW ecosystem, the larger the reward pool grows, making staking a dynamic and rewarding experience.

Token Burning: Boosting Reward Value

The token burning mechanism plays a crucial role in enhancing staking rewards. When fees are used to burn CAW tokens, the total supply decreases, creating deflationary pressure that can increase CAW’s value over time. For example, if CAW’s price rises from $0.0000000413 to $0.00000005 due to burning, the real-world value of your staking rewards increases by 20%, even without additional staking. This makes CAW tokens staking not just a source of passive income but also a potential long-term investment.

The Role of Layer-2 and Validators

Layer-2: Low Fees, High Rewards

CAW’s expansion to Layer-2 (L2) solutions has made staking more accessible and rewarding. On L2, transaction costs drop significantly – from $5-20 on Ethereum’s Layer-1 to just $0.05 on L2. This affordability encourages more users to participate in activities like staking, cross-chain transactions, and NFT minting, which in turn increases the reward pool. L2 also enhances scalability, ensuring CAW can handle millions of users without compromising on decentralization. For more on CAW’s technical vision, see CAW’s Vision for a Decentralized Social Network.

Validators: The Backbone of CAW’s Ecosystem

Validators play a key role in CAW’s L2 ecosystem by batch processing transactions and covering gas fees for users. In return, they earn higher rewards than regular stakers and can receive optional tips as a thank-you for their contributions. Becoming a validator is open to anyone, making it a fantastic opportunity to support CAW’s decentralized social network while earning extra rewards. Validators also use the same O(1) algorithm to distribute rewards, ensuring efficiency across the network.

Maximizing Your CAW Staking Rewards

Tips for Effective Staking

To get the most out of CAW tokens staking, consider these strategies when CAW mainnet:

- Stake Early and Long-Term: The longer you stake, the more rewards you accumulate, especially as ecosystem activity grows.

- Participate in Ecosystem Activities: Engage in cross-chain transactions or mint NFT usernames to increase the reward pool, benefiting all stakers.

- Monitor L2 Activity: Keep an eye on CAW’s L2 expansion, as increased transaction volume directly correlates with higher rewards.

- Consider Becoming a Validator: If you have the technical know-how, running a validator node can yield higher rewards and tips.

Understanding APY Calculations

CAW’s Annual Percentage Yield (APY) for staking is currently calculated off-chain by CawClients, as noted by the CAW developers. This means the exact APY can vary based on ecosystem activity and isn’t directly encoded in the smart contract. However, the team is working on integrating APY calculations into the code for greater transparency. For now, users can estimate returns by monitoring reward payouts and CAW’s price trends, which are influenced by token burning.

Why Stake CAW?

Financial and Community Benefits

Staking CAW tokens offers more than just financial rewards – it’s a way to actively support a decentralized social network that prioritizes free speech and user empowerment. By staking, you contribute to CAW’s growth, helping it achieve its vision of mass adoption in Web3. Financially, staking provides a passive income stream, with the potential for increased value through token burning. It’s a chance to be part of a movement while growing your crypto portfolio.

Connection to CAW’s Broader Vision

CAW’s staking rewards are deeply tied to its mission of building a censorship-resistant social platform. The fees that fund rewards come from ecosystem activities that drive CAW’s growth, such as cross-chain interactions and NFT minting – all of which support the development of a decentralized social network. Curious about the intriguing parallels between CAW and Elon Musk? Explore The Incredible Coincidences Between CAW and Elon Musk to learn more about CAW’s unique journey.

Get Started with CAW Staking when mainnet!

CAW’s staking rewards system is a gateway to earning passive income while supporting a revolutionary Web3 project. With low-cost transactions on Layer-2, an efficient O(1) algorithm, and the value-boosting effects of token burning, staking CAW tokens is a smart move for any crypto enthusiast. Ready to start? Soon!

For more insights, watch our in-depth videos on the CAW YouTube channel and How to buy Caw.

I will stake CAW when it mainnet

Stake and burn will make CAW to the moon

I will join validator